Investment process and research technology designed to identify manager skill

Identifying what makes a manager exceptional is the first stage in building an investment solution that achieves balance between performance and risk.

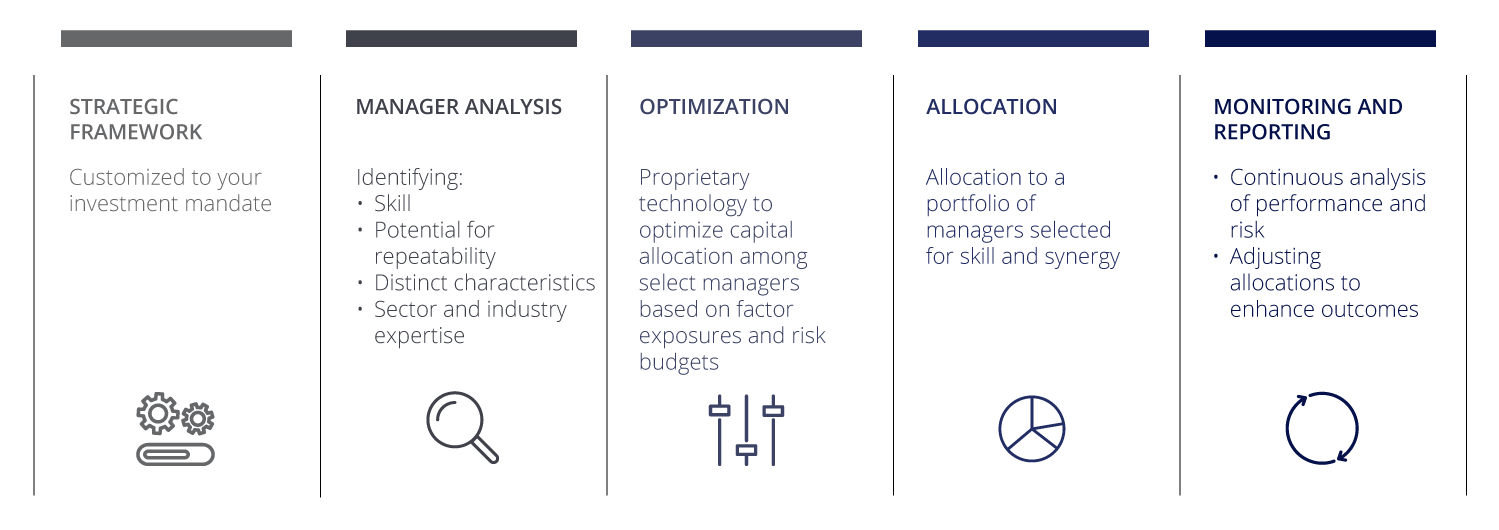

Our proprietary research platform serves as the foundation of an investment process that develops customized solutions for specific investor objectives. We carefully and methodically weigh the potential for repeatable outcomes – by individual managers and by custom groupings of managers – to achieve investors’ nuanced investment goals.

Our research platform operates on multiple data inputs and narratives. We process information through proprietary models and analytics to deliver quantitative and qualitative analyses of individual managers, and potential blends of managers and strategies.

We analyze individual managers’ stock selection efficiency, investment style, performance drivers, risk profile, and risk-adjusted performance. We identify the unique features of a manager’s style, determine whether they are repeatable and sustainable, and evaluate whether this provides the manager with a competitive edge. We confirm operational capabilities, staff proficiency, and the ability of investment infrastructure to support a robust investment model.

In combining multiple emerging managers into a client’s strategic allocation, we consider aggregated risk and factor exposures and multiple possible allocations to arrive at an optimized solution. We seek to maximize the benefits derived from each manager’s specific skills, to diversify and manage the overall portfolio’s style, and risk factors while limiting volatility.

We integrate risk management through every stage of the investment process. We deliver managed portfolios positioned to achieve an attractive risk-reward balance over full market cycles.

Leading Edge Investment Process